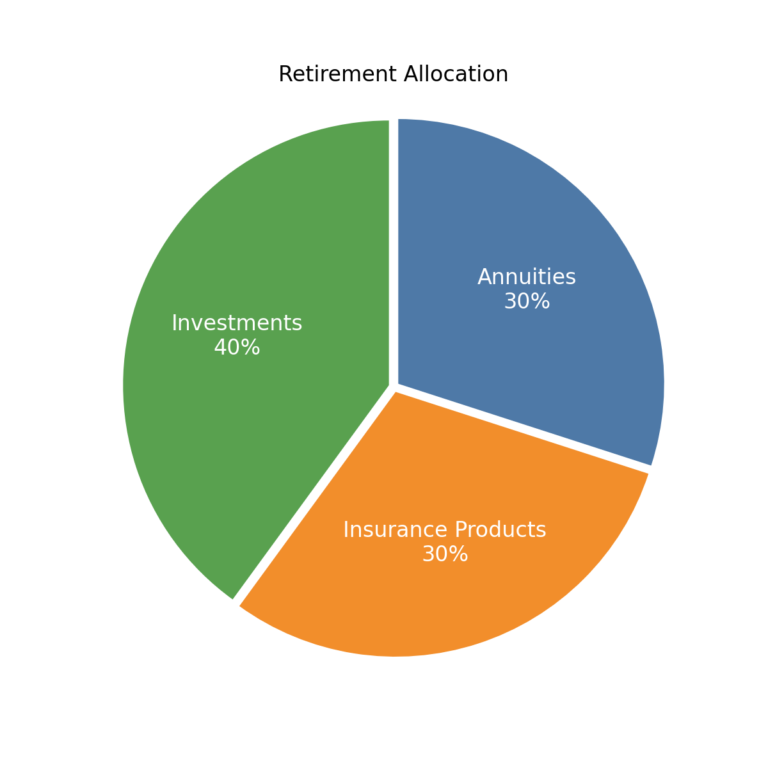

Retirement planning has evolved significantly over the years, moving beyond the traditional focus on savings accounts and stock market investments. A recent report by Ernst & Young (EY) offers a compelling perspective on how to structure a retirement portfolio for optimal financial security and legacy planning. The report suggests a balanced approach, recommending that a retirement portfolio should ideally consist of 30% annuities, 30% insurance products, and 40% investments. This allocation aims to provide retirees with a stable income, protection against financial risks, and growth potential to ensure a comfortable and secure retirement. Interestingly, EY, a global leader in professional services, does not sell insurance products, making their recommendation particularly noteworthy as it stems from an objective analysis rather than a sales pitch.

Understanding the 30-30-40 Retirement Portfolio

The EY report, titled “Benefits of Integrating Insurance Products into a Retirement Plan,” emphasizes the value of integrating insurance products alongside traditional investments to create a robust retirement strategy. The suggested allocation of 30% annuities, 30% insurance products, and 40% investments is designed to address three critical aspects of retirement planning: income stability, risk management, and wealth growth. Let’s break down each component and explore why this mix is gaining attention.

30% Annuities: Ensuring a Steady Income Stream

Annuities are financial products that provide a guaranteed income stream, typically for life or a specified period. They are particularly appealing for retirees who want to ensure they won’t outlive their savings—a growing concern as life expectancies increase. By allocating 30% of a retirement portfolio to annuities, individuals can secure a predictable income to cover essential expenses such as housing, healthcare, and daily living costs.

Annuities come in various forms, including fixed, variable, and indexed annuities. Fixed annuities offer a guaranteed payout, providing stability regardless of market fluctuations. Variable annuities allow for potential growth tied to investment performance, while indexed annuities offer a balance between guaranteed returns and market-linked growth. The EY report highlights that annuities can act as a “personal pension,” filling the gap left by declining traditional pension plans. For a 25-year-old couple planning for retirement, the report’s analysis shows that incorporating annuities can lead to a more predictable and sustainable income stream compared to relying solely on investments.

30% Insurance Products: Managing Risks

The inclusion of insurance products in a retirement portfolio is a less conventional but increasingly relevant strategy. Insurance products, such as permanent life insurance (PLI) or long-term care insurance, serve as a hedge against financial risks that could derail retirement plans. The EY report suggests that allocating 30% of a portfolio to insurance products can protect against unforeseen events, such as premature death, disability, or significant healthcare costs.

Permanent life insurance, for instance, not only provides a death benefit but also builds cash value over time, which can be accessed during retirement for supplemental income or emergency expenses. The report’s analysis demonstrates that PLI combined with investments outperforms both investment-only and term life insurance plus investment strategies in terms of projected retirement income and legacy for a young couple. This is particularly valuable for retirees who want to leave a financial legacy for their heirs while maintaining liquidity during their lifetime. Long-term care insurance, on the other hand, addresses the rising costs of healthcare in retirement, which can quickly deplete savings if not planned for.

40% Investments: Driving Growth

Investments, including stocks, bonds, and mutual funds, remain a cornerstone of retirement planning, offering the potential for wealth growth over time. The EY report recommends allocating 40% of a retirement portfolio to investments to capitalize on market opportunities and combat inflation. Unlike annuities and insurance products, which prioritize stability and protection, investments are geared toward long-term growth, allowing retirees to maintain their purchasing power and fund discretionary expenses like travel or hobbies.

The report underscores the importance of diversification within the investment portion of the portfolio. A mix of equities, fixed-income securities, and alternative investments can balance risk and reward, ensuring that the portfolio remains resilient in various market conditions. For example, younger investors might lean toward growth-oriented stocks, while those closer to retirement may prioritize bonds or dividend-paying securities for stability. The 40% allocation to investments ensures that retirees can benefit from market growth while the annuities and insurance components provide a safety net.

The Unique Angle: EY’s Objective Perspective

One of the most intriguing aspects of the EY report is that Ernst & Young does not sell insurance products. Unlike financial institutions or insurance companies that might promote products for profit, EY’s recommendation comes from an impartial analysis aimed at providing value to retirement investors. This objectivity lends credibility to their suggestion, as it is driven by data and financial modeling rather than a desire to push proprietary products.

EY’s analysis shows that integrating insurance products into a financial plan provides measurable benefits, such as higher projected retirement income and legacy compared to traditional investment-only strategies. For instance, their study of a 25-year-old couple illustrates that a portfolio combining permanent life insurance with investments outperforms both investment-only and term life plus investment strategies. This finding challenges the conventional wisdom that insurance products are primarily for protection and highlights their potential as a strategic component of retirement planning. By advocating for a balanced portfolio without a vested interest in selling insurance, EY underscores the genuine value these products can bring to retirees.

Why This Allocation Makes Sense

The 30-30-40 allocation is designed to address the multifaceted needs of retirees in today’s complex financial landscape. Retirement planning is no longer just about accumulating wealth; it’s about managing longevity risk, healthcare costs, market volatility, and legacy goals. Here’s why this balanced approach resonates:

- Mitigating Longevity Risk: With people living longer, the risk of outliving one’s savings is a significant concern. Annuities provide a guaranteed income stream, ensuring that retirees can maintain their lifestyle regardless of how long they live.

- Protecting Against Unexpected Costs: Healthcare and long-term care costs can be astronomical in retirement. Insurance products like long-term care insurance or the cash value in permanent life insurance can act as a financial buffer, preserving other assets.

- Balancing Growth and Stability: Investments offer growth potential to keep pace with inflation, while annuities and insurance products provide stability and protection. The 40% allocation to investments ensures that the portfolio can grow, while the remaining 60% safeguards against downside risks.

- Legacy Planning: For those who wish to leave a financial legacy, insurance products like permanent life insurance can provide a tax-efficient way to transfer wealth to heirs, as highlighted in EY’s analysis.

Practical Considerations for Implementation

Adopting the 30-30-40 portfolio requires careful planning and consultation with financial advisors. Here are some steps to consider:

- Assess Your Needs: Work with a financial planner to evaluate your retirement goals, risk tolerance, and income needs. This will help determine the appropriate types of annuities and insurance products for your situation.

- Diversify Investments: Ensure the 40% investment portion is diversified across asset classes to balance risk and reward. Consider low-cost, index-based funds for broad market exposure.

- Review Insurance Options: Explore permanent life insurance or long-term care insurance to address specific risks. Compare products from reputable providers to find the best fit.

- Monitor and Adjust: Regularly review your portfolio to ensure it aligns with your goals and market conditions. Rebalancing may be necessary as you approach retirement or as your financial situation changes.

Conclusion

The EY report offers a fresh perspective on retirement planning by advocating for a balanced portfolio of 30% annuities, 30% insurance products, and 40% investments. This approach addresses the key challenges of retirement—income stability, risk management, and wealth growth—while providing flexibility to meet individual needs. The fact that EY does not sell insurance products adds a layer of credibility to their recommendation, emphasizing the objective value of integrating insurance into a retirement plan. As retirees face an increasingly complex financial landscape, this 30-30-40 framework provides a roadmap for achieving financial security and peace of mind. For those looking to implement this strategy, consulting with a trusted financial advisor is a critical first step to tailoring the approach to your unique circumstances.